I first learned about the Nomad Fund letters through Richer, Wiser, Happier by William Green. Nick Sleep and Qais Zakaria have proven to be outstanding role models, and their approach to investing captured my interest.

If I were to write annual reports to shareholders, I would aspire for them to be as engaging and insightful as the ones Sleep and Zakaria produced. Although the Nomad Fund closed over a decade ago, their letters remain highly relevant, offering valuable insights into the decision-making processes of these two investors.

What stood out most to me was their prudence when announcing results and their deliberate use of their strengths to shape and refine their investment strategy.

Here are my key takeaways from those letters.

Don’t Be Dogmatic

“Any year you don’t destroy one of your best-loved ideas is probably a wasted year.” — Charlie Munger

While inside ownership is typically seen as a positive sign, there are exceptions. For instance, in the case of Northwest Airlines, union members suspected that management, motivated by significant inside ownership, would go to great lengths to avoid bankruptcy—potentially at the expense of other stakeholders.

Investment Competitive Advantage

According to Bill Miller, there are three primary types of competitive advantages in investing:

- Informational: Possessing knowledge that others do not have.

- Analytical: Reaching superior conclusions from the same data (highlighting the importance of understanding your circle of competence).

- Psychological: Leveraging behavioral advantages.

Focus on the Psychological Advantage

Group Think

Investors are heavily influenced by the behavior of the crowd, which often leads to buying high and selling low. Overcoming group think is essential for maintaining a rational, independent perspective.

Availability Bias

We tend to overweight the significance of recent events and easily accessible information. This bias can distort perception, causing investors to make decisions based on what is most memorable rather than what is most relevant or accurate.

Probability-Based Thinking

Investing requires assessing the most likely outcomes based on management actions, competitive pressures, and potential valuation changes. Mastering this type of probabilistic thinking is crucial for making informed investment decisions.

Patience

When asked about the primary difference between himself and the average investor, Warren Buffett simply replied, “patience.” This virtue allows investors to wait for the right opportunities and hold through periods of uncertainty, fostering long-term success.

Investment Models

The essence of a competitive advantage is its ability to make future outcomes more predictable. In their investment letters, Nick Sleep and Qais Zakaria outline two types of businesses they favor.

Scale Efficiencies Shared

Example: Costco

Costco exemplifies the “scale efficiencies shared” model by passing cost savings to consumers, fostering customer loyalty and sustainable growth.

Robustness Ratio: This is a framework Sleep and Zakaria use to measure the size of a company’s competitive advantage. The formula is:

Robustness Ratio = Amount of money saved by the customer / Amount of money earned by shareholders

This model is particularly suited for companies with a value proposition based on low prices, like Costco, and is less applicable to companies without a strong focus on cost leadership.

Deep Discount to Replacement Cost with Latent Pricing Power

This model involves investing in businesses that are significantly undervalued relative to their normalized value, offering strong potential returns even if normalization takes up to a decade.

Premise: A company needs to eventually replace its assets and must price its products or services in a way that:

- Funds Capital Expenditures (CAPEX).

- Economically Justifies Ongoing Investment.

Investing based on this principle ensures that even if the reversion to normalized value is gradual, it can still yield substantial long-term returns.

2002 Nomad Fund Investment Criteria

The Nomad Fund’s investment approach in 2002 focused on finding opportunities that aligned with the following principles:

- Businesses Trading at a Discount: Targeting companies trading at approximately half of their intrinsic business value.

- Owner-Oriented Management: Ensuring that company leaders have an ownership mindset and align their interests with those of shareholders.

- Long-Term Capital Allocation Strategy: Looking for a capital allocation approach that prioritizes sustainable, long-term value creation for shareholders.

Additional Indicators Monitored:

- Share Repurchases: Keeping an eye on companies that buy back their own shares, signaling potential undervaluation.

- Insider Buying: Tracking insider purchases as a sign of confidence in the company’s future prospects.

Focus on Management Character

To achieve long-term returns, capital allocation must consistently align with value creation. However, managers often become distracted by diversifying activities that ultimately lead to “deworsification,” as Peter Lynch famously put it.

Proxy for Management Character: One indicator of strong management character is stability in shares outstanding. Ideally, there should be no significant increase or decrease in shares outstanding over the last 10 years.

The average long-term rate of share issuance in the U.S. is approximately 3% per annum. If capital raised through share issuance is used effectively, it can benefit shareholders. However, problems arise when permanent capital is used to pursue short-term outcomes, especially when managed by executives with brief employment contracts. This creates a duration mismatch that can harm long-term value creation and shareholder interests.

Metrics I learned about

Share of voice

Share of voice: share of industry marketing spend. With consumer goods when share of voice is higher than market share, the market share tends to rise.

Price to value ratio

The ultimate goal of Nomad fund is to decrease price to value ratio.

When buying they try to be at 50 cents on the dollar and then try to keep it low by regularly repurchasing stocks at low prices.

Story: Accounting Standards and Xerox Fraud

Xerox’s accounting practices for lease contracts highlight how discretion in financial reporting can be exploited. The company sold printers bundled with five-year service contracts. Management had significant leeway in how they allocated revenue between the sale of equipment and future maintenance. This flexibility opened the door to manipulation and misrepresentation of earnings.

Discipline

- Limit Capital Acceptance: Only take on new investors to the extent that you can effectively deploy capital without diluting returns.

- Avoid Being a Sales Agent for Your Investments: Promoting your investment decisions to others can trigger consistency bias, making it harder to objectively reassess your choices. While confidence in your investments is essential, remember that unforeseen company actions can still affect outcomes.

Coaching the fund’s Investors

Patience: Encourage investors to adopt a long-term perspective by evaluating fund performance over rolling five-year periods.

Ensure your communication is clear and understandable to maintain trust and alignment.

Fee structure: solving the principal agent problem

Management Fee

The management fee is designed to cover the fund’s recurring operational costs. It is not intended to generate profit for the fund but simply to ensure it can function effectively. This is often referred to as a “cost-covering fee.”

Performance Fee

The performance fee structure typically involves taking 20% of the fund’s annual performance above a 6% hurdle rate, with a high-water mark to ensure fees are only collected on genuine gains. However, a challenge arises with this annual fee structure—it doesn’t align with the five-year evaluation period that fund managers often request for assessing long-term performance.

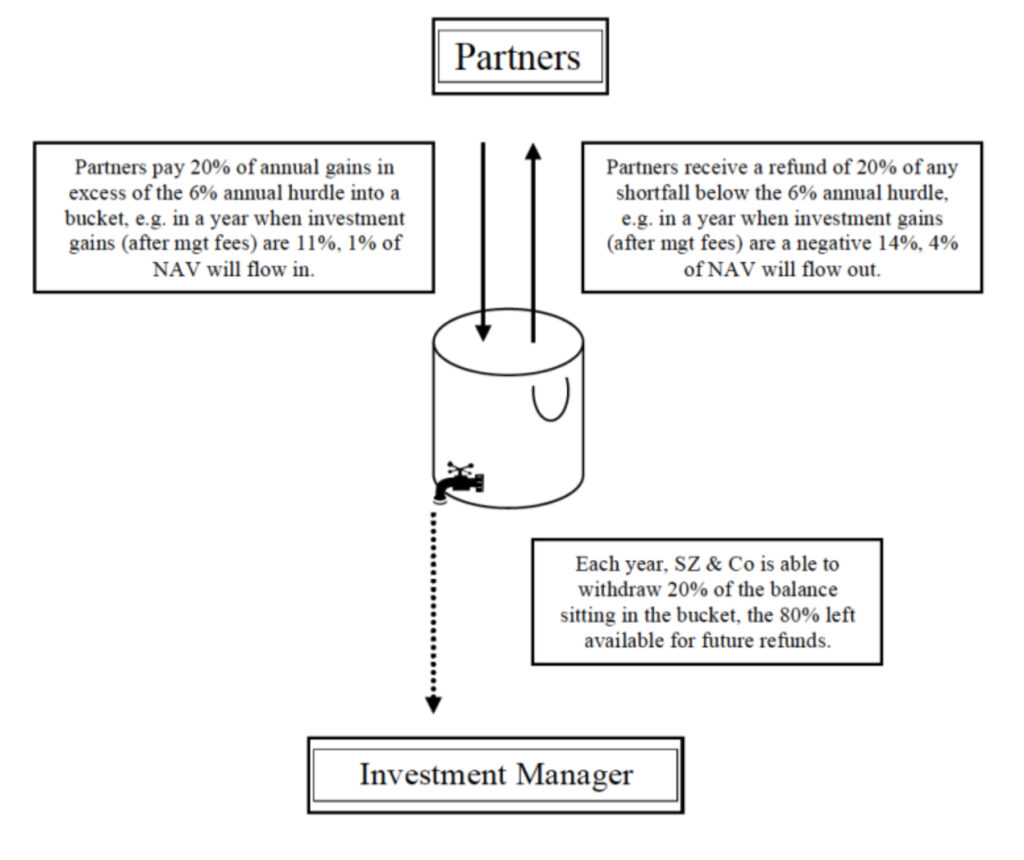

To address this, they introduced a performance fee bucket: